|

| GEP |

Nurturing Financial Stability: The Art of Family Budgeting and Personal Financial Management

Managing personal finances and establishing a solid family budget are crucial skills that contribute to overall financial well-being. By adopting effective budgeting and financial management practices, individuals and families can gain control over their expenses, save for the future, and achieve their financial goals. In this article, we will delve into the importance of family budgeting and personal financial management, offering practical insights and strategies to help you nurture financial stability.

Understanding the Need for Budgeting:

Budgeting serves as the foundation for sound financial management. It allows you to track income and expenses, identify spending patterns, and make informed financial decisions. By creating a budget, you gain a clear picture of where your money is going, enabling you to allocate funds wisely and prioritize your financial goals.

|

| NapkinFinance |

Establishing a Family Budget:

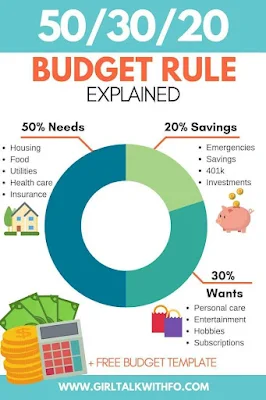

Creating a family budget involves the active participation of all family members. Start by gathering information on your household income and listing all necessary expenses, including bills, groceries, transportation, and debt payments. Categorize your expenses as fixed (unchanging) or variable (fluctuating). Set realistic spending limits for each category, ensuring that your income covers your essential needs while leaving room for savings and discretionary spending.

Tracking and Managing Expenses:

Once your budget is in place, it is essential to track and manage your expenses diligently. Keep a record of all your expenditures, either manually or by using budgeting apps or spreadsheets. Regularly review your spending patterns to identify areas where you can cut back or find more cost-effective alternatives. This practice helps you stay accountable and make adjustments to align your spending with your financial goals.

Saving and Emergency Funds:

Building an emergency fund is a crucial step in personal financial management. Aim to set aside three to six months' worth of living expenses to provide a safety net in case of unexpected events like medical emergencies, job loss, or home repairs. Additionally, establish a regular savings plan to achieve long-term goals such as homeownership, education, retirement, or vacations. Automating savings contributions can make it easier to stay consistent.

Managing Debt:

Debt management is a vital aspect of personal finance. Prioritize paying off high-interest debts, such as credit card balances or personal loans, to minimize interest charges. Consider consolidating debts or negotiating with creditors to secure more favorable terms. Adopt responsible borrowing habits and aim to use credit wisely, keeping your credit utilization low and paying bills on time to maintain a healthy credit score.

|

| Shutterstock |

Setting Financial Goals:

Clearly defined financial goals provide a sense of purpose and motivation for your budgeting efforts. Establish short-term goals (e.g., paying off a credit card), medium-term goals (e.g., saving for a down payment), and long-term goals (e.g., retirement planning). Break down each goal into manageable steps and track your progress regularly. Celebrate milestones along the way to stay motivated and focused on achieving financial success.

Seeking Professional Guidance:

If you find managing your finances overwhelming or have complex financial situations, do not hesitate to seek professional guidance. Financial advisors or planners can provide personalized strategies, offer expert advice, and help optimize your financial plan based on your unique circumstances. They can also assist in investment planning, tax optimization, and retirement planning, ensuring your long-term financial security.

|

Family budgeting and personal financial management are invaluable tools that empower individuals and families to take control of their financial futures. By creating a comprehensive budget, tracking expenses, saving diligently, managing debt wisely, setting goals, and seeking professional guidance when necessary, you can nurture financial stability and work towards achieving your dreams. Remember, financial success is a journey that requires discipline, adaptability, and a commitment to long-term planning. Start today and pave the way for a brighter financial future for you and your family.